Information about the estimators can be found in the User’s Guide.

Subscribe to our Newsletter

DOWNLOADS

Free Trial

DLOM CALCULATORS

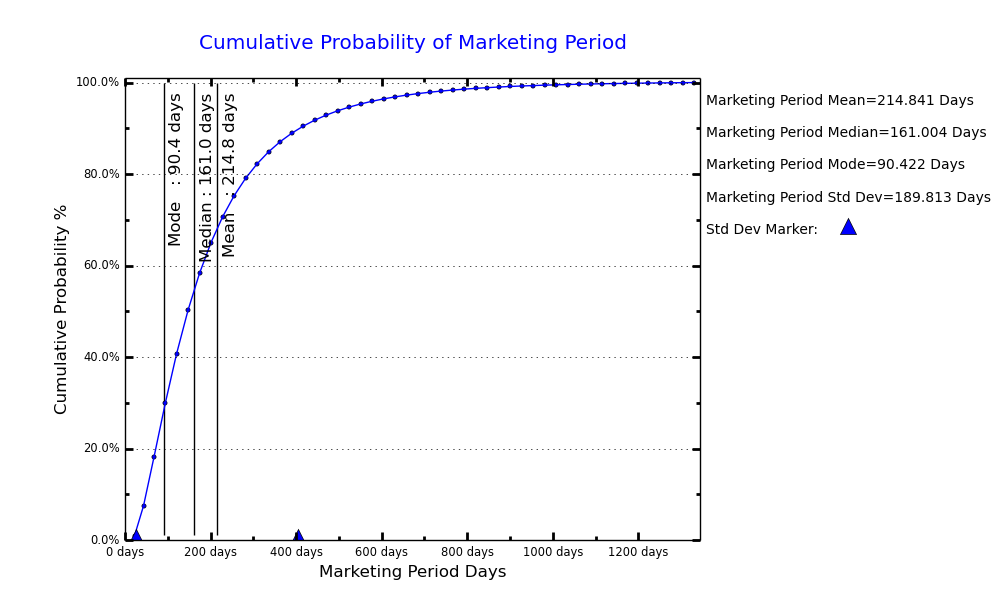

TIME/PRICE ESTIMATORS

TUTORIALS

- Instant Probability-Based DLOM calculations.Smarter asset management decisions.Shorter memberships for reduced-cost engagements.Longer memberships for added timeframe convenience at significant discounts.

Sample Reports

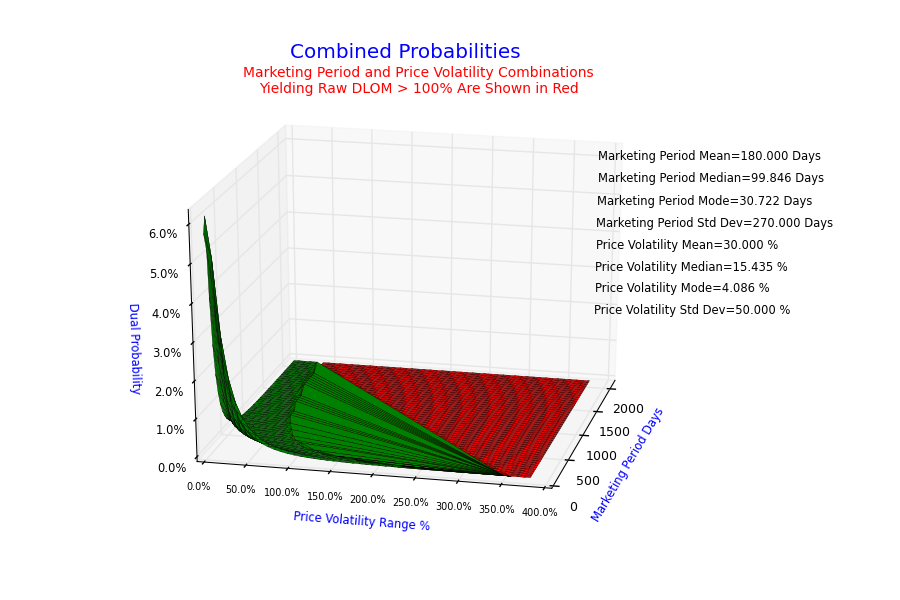

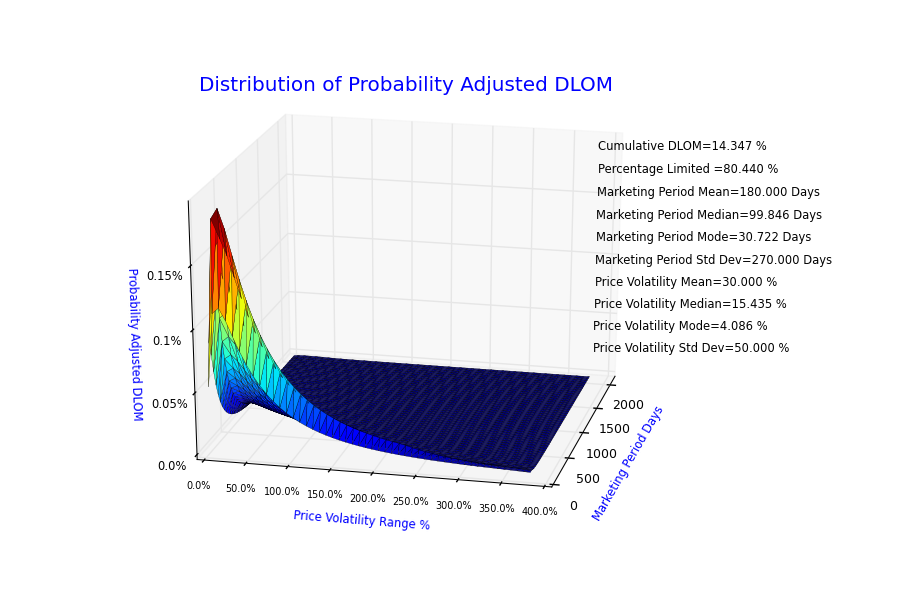

SAMPLE CHARTS

Questions?

Contact Us for more information.